Condo Insurance in and around Hiawatha

Here's why you need condo unitowners insurance

State Farm can help you with condo insurance

- Cedar Rapids

- Hiawatha

- Marion

- Omaha

- Iowa City

- Lincoln

- Des Moines

- Davenport

- Dubuque

- Linn County

- Illinois

- Nebraska

- Minnesota

- Grand Island

- Tiffin

- Waukee

- Aurora

- Naperville

- Ames

- Sioux City

- Fairfax

- Solon

- Mount Vernon

- Peoria

Home Is Where Your Condo Is

Looking for a policy that can help insure both your condominium and the clothing, sports equipment, mementos? State Farm offers incredible coverage options you don't want to miss.

Here's why you need condo unitowners insurance

State Farm can help you with condo insurance

Why Condo Owners In Hiawatha Choose State Farm

Condo unitowners coverage like this is what sets State Farm apart from the rest. Agent Mitch Valentine can be there whenever mishaps occur to help you submit your claim. State Farm is there for you.

That’s why your friends and neighbors in Hiawatha turn to State Farm Agent Mitch Valentine. Mitch Valentine can help clarify your liabilities and help you make sure your bases are covered.

Have More Questions About Condo Unitowners Insurance?

Call Mitch at (319) 395-0035 or visit our FAQ page.

Simple Insights®

Power outage preparedness tips

Power outage preparedness tips

Learn some power outage preparedness tips, including what do before, during and after it happens.

How to deal with noisy neighbors or issues

How to deal with noisy neighbors or issues

From noisy neighbors and arguments over property lines to adventurous pets, there are ways to successfully resolve disputes between neighbors.

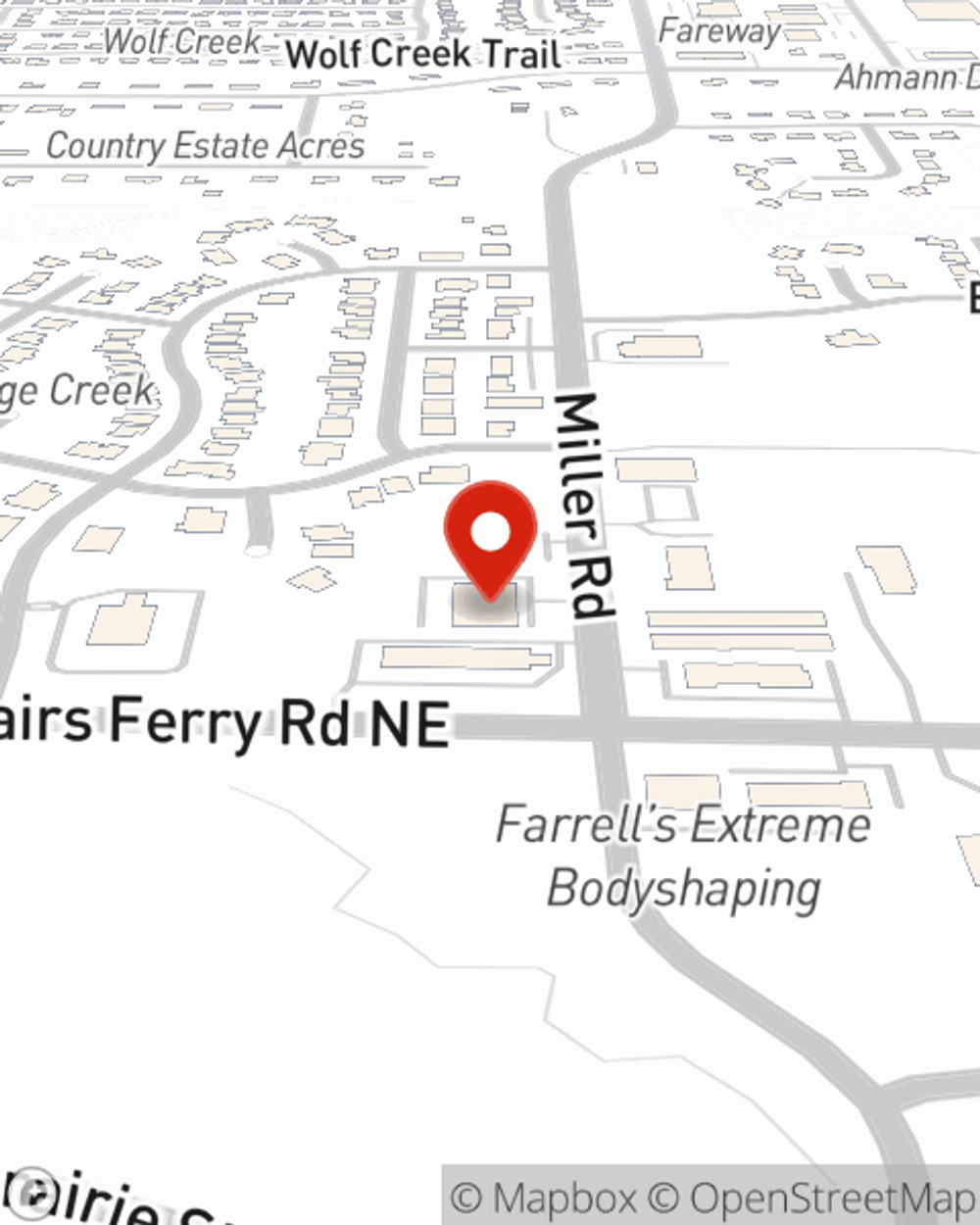

Mitch Valentine

State Farm® Insurance AgentSimple Insights®

Power outage preparedness tips

Power outage preparedness tips

Learn some power outage preparedness tips, including what do before, during and after it happens.

How to deal with noisy neighbors or issues

How to deal with noisy neighbors or issues

From noisy neighbors and arguments over property lines to adventurous pets, there are ways to successfully resolve disputes between neighbors.